Understanding Wage Theft in New York, NY: Your Legal Rights Explained

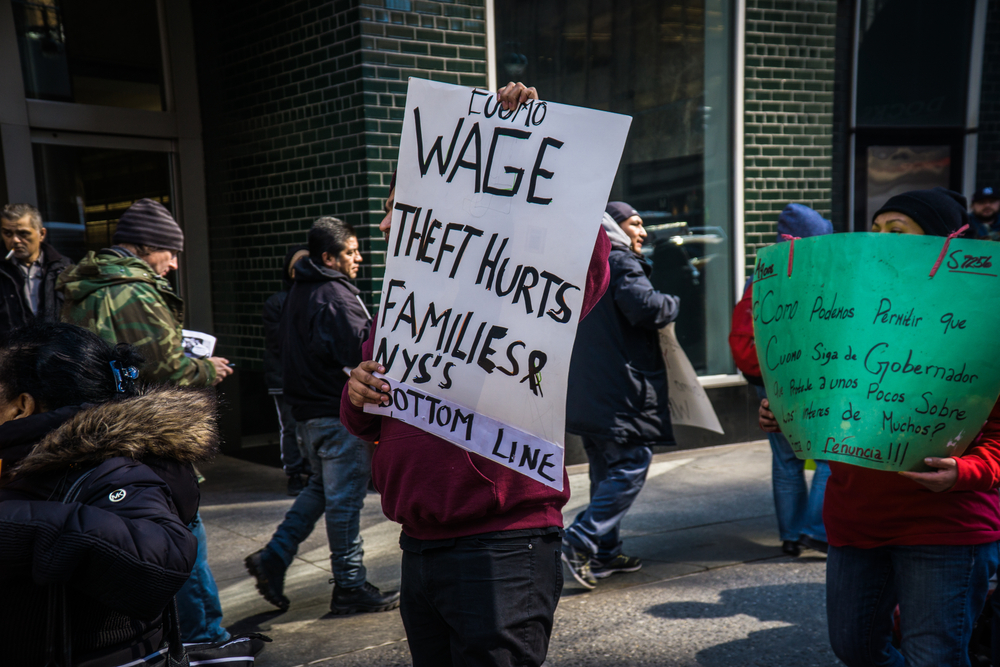

Wage theft is an issue that affects countless workers across New York City, particularly those in vulnerable industries. It occurs when employers fail to pay employees what they are legally owed. Despite legal protections, many workers are unaware of their rights or unsure of how to take action when they are victims of wage theft. This article explores the complexities of wage theft in New York, outlines workers’ legal rights, and provides guidance on how to seek justice.

What is Wage Theft?

Wage theft is a term that encompasses various unlawful practices related to employee compensation. This includes but is not limited to:

- Failure to pay minimum wage

- Overtime violations

- Withholding tips

- Forcing employees to work “off the clock”

- Misclassifying employees as independent contractors to avoid paying benefits and wages

Understanding these forms of wage theft is critical for workers to protect their earnings and rights.

New York Labor Laws: An Overview

New York has some of the most comprehensive labor laws designed to protect employees’ rights and ensure fair pay. The following sections highlight key legal protections and how they apply in wage theft cases.

Minimum Wage and Overtime Requirements

In New York, the minimum wage varies depending on the location and size of the employer. As of recent years, the minimum wage for employers with 11 or more employees in New York City is $15 per hour. Smaller employers (10 or fewer) are also required to pay $15 per hour.

The overtime rate applies when employees work more than 40 hours per week. Non-exempt employees are entitled to 1.5 times their regular pay for any hours worked beyond this threshold.

Tip Protection for Service Workers

Many service industry workers, such as waitstaff and bartenders, rely on tips as a substantial portion of their income. Under New York law, employers are prohibited from withholding any portion of tips. Additionally, tip pooling is allowed but must be conducted fairly and cannot include managers or supervisors.

Independent Contractor Misclassification

One of the most common forms of wage theft occurs when employers misclassify workers as independent contractors instead of employees. This misclassification allows employers to avoid providing essential benefits like overtime pay, unemployment insurance, and workers’ compensation.

New York courts consider several factors to determine if a worker is misclassified, including the degree of control the employer exerts over the worker and whether the worker is economically dependent on the employer.

Recognizing the Signs of Wage Theft

Wage theft can be difficult to detect, especially when employers use deceptive practices. Some common signs include:

- Receiving inaccurate pay stubs or no pay stubs at all

- Regularly working off the clock without pay

- Being paid less than the promised wage

- Misleading or unclear information about tip deductions

Workers who notice these signs should take immediate steps to document their experiences and seek legal advice if necessary.

Legal Recourse for Wage Theft Victims in New York

New York provides multiple avenues for employees seeking justice after experiencing wage theft. Understanding these legal options is essential to recovering lost wages.

Filing a Complaint with the New York Department of Labor

One of the primary ways to address wage theft is by filing a complaint with the New York Department of Labor (DOL). The DOL investigates claims of wage violations and can impose penalties on employers found guilty of wage theft.

Initiating a Private Lawsuit

Employees also have the option to file a private lawsuit against their employer. This approach is often necessary when large sums of unpaid wages are involved or when multiple workers have been affected. In some cases, employees can pursue class-action lawsuits, which allow groups of workers to seek compensation collectively.

The Statute of Limitations

In New York, the statute of limitations for filing a wage theft claim is six years. This means that employees can recover unpaid wages and damages for violations that occurred within this timeframe.

Retaliation Protections for Workers

It is illegal for employers to retaliate against workers who report wage theft or file claims. Retaliation can include termination, demotion, or any form of harassment aimed at discouraging workers from asserting their rights. Employees who experience retaliation may be entitled to additional compensation and job reinstatement.

Remedies and Compensation for Wage Theft

Employees who successfully prove wage theft can recover several forms of compensation, including:

- Back pay: The wages an employee should have received.

- Liquidated damages: Additional compensation equal to 100% of the unpaid wages in many cases.

- Attorney’s fees and legal costs: Reimbursement for the costs of pursuing a legal claim.

In cases involving egregious violations, employers may also face fines and penalties imposed by state authorities.

Preventing Wage Theft: What Workers Can Do

Workers can take proactive steps to prevent wage theft by understanding their rights and documenting their work conditions. Some key actions include:

- Keeping detailed records: Maintain copies of work schedules, pay stubs, and communication with employers.

- Understanding employment contracts: Review and understand any agreements related to compensation and job duties.

- Joining worker advocacy groups: Organizations such as labor unions and nonprofit legal groups can provide crucial support and resources.

By staying informed and organized, workers can build stronger cases and avoid common pitfalls when addressing wage theft.

Seeking Legal Help for Wage Theft Cases

Navigating wage theft cases can be challenging, particularly for those unfamiliar with labor laws. Fortunately, New York has numerous resources available to support workers in their fight for fair compensation.

Legal Aid Organizations

Several nonprofit organizations in New York provide free or low-cost legal services to victims of wage theft. These organizations often specialize in labor law and can assist workers in filing complaints, understanding their rights, and pursuing legal action.

Private Employment Attorneys

In cases involving significant financial losses, consulting with an experienced employment attorney can be highly beneficial. Private attorneys can provide personalized legal advice and represent employees in lawsuits, maximizing the chances of a favorable outcome.

Conclusion

Wage theft remains a serious issue that affects workers across New York, especially in industries where vulnerable populations are often exploited. By understanding the various forms of wage theft, the legal protections available, and the steps to take when facing wage violations, workers can empower themselves to fight for their rights and seek justice. With strong labor laws and supportive legal resources, New York workers have the tools they need to recover lost wages and hold employers accountable for their actions.

Need an Attorney in NYC, NY?

Welcome to The Law Offices Of Randy A. Hernandez, PLLC, where legal excellence meets unwavering dedication. Our commitment to delivering exceptional legal services is the cornerstone of our practice. As a leading law firm, we take pride in our reputation for providing personalized, strategic, and effective legal solutions to individuals and businesses alike. Founded on the principles of integrity, expertise, and client-focused service, The Law Offices Of Randy A. Hernandez, PLLC is dedicated to navigating the complexities of the legal landscape with precision and care. Our team of seasoned attorneys brings a wealth of experience, ensuring that every client receives the highest level of representation. Contact us today.